What is a fuel tax surety bond?

A fuel tax surety bond is a type of financial guarantee that is required in order to obtain a license to sell fuel. The purpose of the bond is to protect the state from any losses that may occur as a result of the fuel dealer not paying the required taxes.

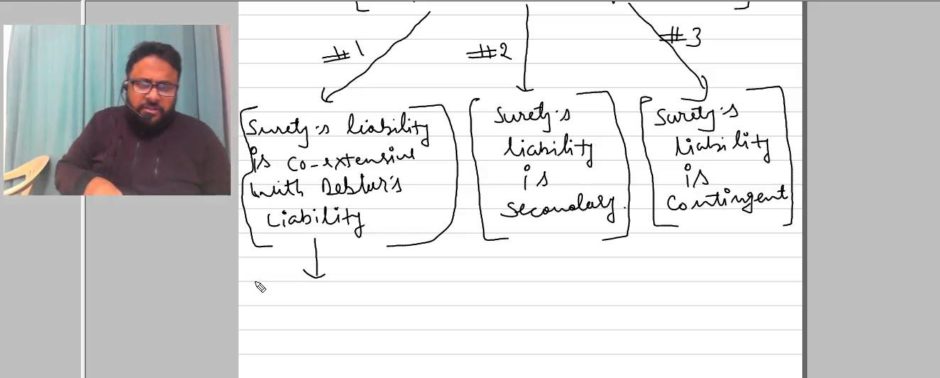

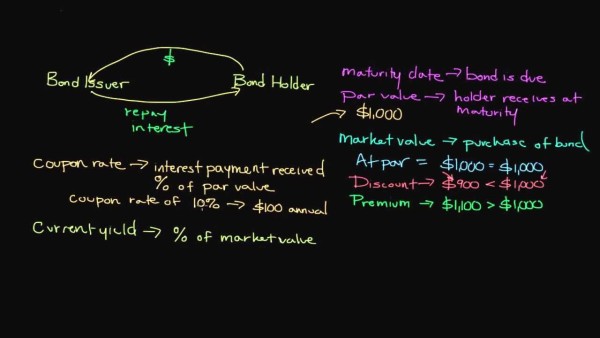

The surety company that issues the bond will be responsible for paying any claims that are filed against the bond. In order to obtain a bond, the fuel dealer will need to submit an application and pay a premium. The premium is typically a percentage of the total value of the bond.

When applying for a fuel tax surety bond, it is important to make sure that all of the necessary information is included in the. This includes the name and contact information for the fuel dealer, as well as a description of the business. The surety company will also need to know the amount of the bond and the state in which it will be used.

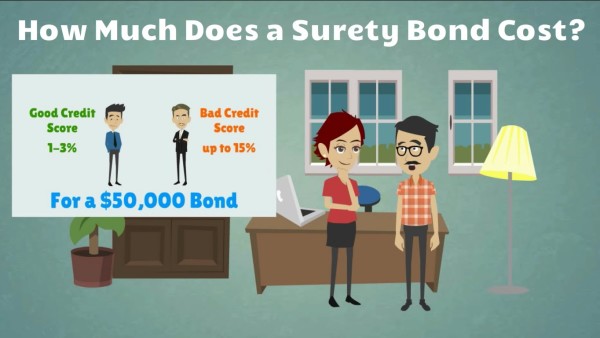

How much does a fuel tax surety bond cost?

A fuel tax surety bond typically costs between 1-3% of the total bond amount. The specific cost will depend on a number of factors, including the applicant’s credit score, the type of business, and the financial strength of the surety company.

However, in general, applicants with good credit can expect to pay around 1% of the total bond amount. Those with poor credit may have to pay closer to 3%. The total bond amount is set by the state in which the applicant operates and typically ranges from $5,000 to $10,000.

To get a more specific idea of how much your fuel tax surety bond will cost, we recommend getting quotes from a few different bonding companies. This way, you can compare rates and choose the best option for your business. To get started, simply fill out our online application. We’ll then match you with up to 3 surety companies that are best suited to your needs. From there, you can compare rates and decide which company is right for you.

What is a fuel tax surety bond for?

A fuel tax surety bond is a type of financial guarantee that is required by many states in order to obtain a license to sell fuel. The bond protects the state from losses that may occur if the fuel seller does not pay the required taxes.

The amount of the bond varies from state to state but is typically a few thousand dollars. In some cases, the bond may be higher if the fuel seller has a history of not paying taxes.

Fuel tax surety bonds are typically valid for one year but can be renewed on an annual basis. If the fuel seller fails to pay the required taxes, the state can make a claim against the bond to recoup its losses.

When is a fuel tax surety bond needed?

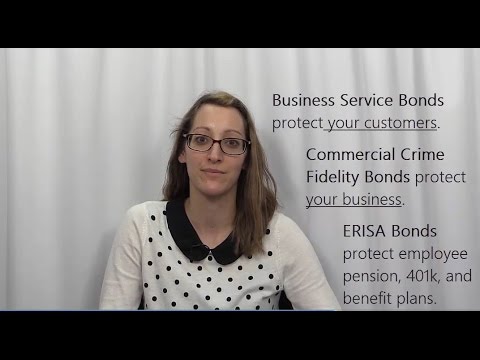

If your business involves the storage, distribution, or sale of motor fuel, you may be required to obtain a fuel tax surety bond. The purpose of this bond is to ensure that you will remit all taxes and fees owed to the state in which you operate.

There are a few different scenarios in which you may need a fuel tax surety bond. If you are applying for a license to store or distribute fuel, you will likely be required to post a bond. In some cases, bonds may also be required if you are changing the type of license your business holds, or if you are renewing your license.

The amount of the bond will vary depending on the state in which you operate, but is typically a percentage of your estimated tax liability. For example, in Pennsylvania, the bond amount is set at 10% of your expected fuel tax liability for the year.

Where can you get a fuel tax surety bond?

Fuel tax surety bonds are typically required by state governments in order to ensure that fuel taxes are paid. The bonds can be obtained through a surety company or agent, and the cost of the bond will vary depending on the amount of the bond and the state where it is required.

Some states have specific requirements for the types of surety companies that are authorized to issue fuel tax bonds. For example, in California, only surety companies that are licensed and approved by the Department of Insurance are authorized to issue fuel tax bonds.

If you need a fuel tax surety bond, be sure to check with your state government to find out what is required. The bond amount, surety company, and other requirements may vary depending on the state.